SilverSneakers is not included with Medicare Part A and B or with Tricare for Life(TFL), but is included in some zero premium Medicare Part C plans, also called Medicare Advantage Plans. Currently there are over 32 million Medicare clients on Part C plans nationwide, which are required to provide the same benefits as Part A and B, but can also include vision, hearing, dental coverage and SilverSneakers.

TFL, started in 2001, provides two great benefits for its members-

(1) it pays the copays and deductibles that Medicare Part A and B OR Part C does not cover.

- TFL is the secondary payor.

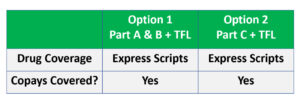

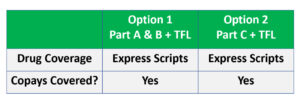

(2) provides excellent prescription drug coverage with Express Scripts.

The first thing I want to make clear is that I am NOT recommending or suggesting you “drop TFL”, “lose TFL”, “mess up TFL” etc.

Most TFL members assume that their only option is stay on original Medicare Part A and B to use their Tricare for Life benefits, but the fact is you can also enroll in a zero premium Medicare Part C plan that is designed for veterans, and still keep your TFL benefits. These plans have only been out since 2019, so that’s why most TFL members are not aware that they exist.

Humana®️ USAA Honor Plan and the UnitedHealthcare®️ Patriot Plan are zero premium Medicare Part C plans designed for veterans. These plans do NOT include drug coverage because you already have Express Scripts, so nothing is affected with your current drug coverage.

Currently, TFL is secondary to Medicare Part A and B, and STAYS secondary if you enroll in a Part C plan. Under your current plan (Medicare Part B) Medicare pays 80% and you have a copay of 20%. The 20% copay gets billed to TFL and they pay it. Medicare Part C plans do not use a 80/20 structure, they cover all costs except a flat copay amount ($20 for primary care visit- $40 for specialist – example). Your doctors office bills TFL for your flat copay amount.

TFL still covers your copays on a Part C plan.

TFL members have a copay now, it is 20% of the Medicare approved service.

Copays on a Part C Plan are a flat amount instead of 20%.

The Humana USAA Honor plan is available in 46 states, is a PPO (not HMO) allowing you to use any doctor who accepts Medicare nationwide and do not require a referral to see a specialist. There is a big difference between a Part C HMO from a small insurance company, which limits your options substantially and a PPO from Humana or UHC. These plans vary slightly from state to state but include these benefits.

– zero premium (Must continue to pay Part B premium)

– vision, hearing and dental coverage ($2000 a year dental max per year typically)

– Medicare Part B premium credit- $75-$125 a month, varies from state to state

– SilverSneakers Gym membership

The standard Medicare Part B premium for 2024 is $174.70 a month. So as an example, if you enroll in a Part C plan with a $100 month Part B credit, your Medicare Part B premium with be $74.70 each month.

This causes your social security check to increase $100 a month or $300 less you pay quarterly if you are not receiving social security benefits. The Part B credit is per person, per month and happens automatically.

Most of you are reading this because you just want to get SilverSneakers. The Humana USAA Honor plan accomplishes that AND saves you $1200+ a year per person on your Medicare Part B premium, includes hearing, vision and dental coverage.

Humana is based in Louisville, KY is very popular in the South and Midwest. Humana also administers the benefits for Tricare East, so TFL members in Tricare East are very familiar with Humana when they had Tricare Prime or Tricare Select. Humana is the only Medicare company to be recommended by USAA.

UnitedHealthcare Patriot plan is often the plan veterans pick in the west, in these markets especially:

– Denver

– Las Vegas

– Phoenix

– Salt Lake City

– Seattle

– Portland

UHC has it’s own version of SilverSneakers called RenewActive, a typically includes that same gyms as SilverSneakers.

My name is Steve Schrader, I work exclusively in the Medicare market as an agent for Humana and UnitedHealthcare. I am one of the few agents in the country that works entirely with Tricare for Life members, helping them understand these plans, which have only been out a couple years. I have TFL members on these plans all across the country and they are very happy they made the switch to a Part C plan designed for them.

The best way to understand these plans are to give me a call when you have 10 minutes, and I NEVER expect you to make a decision at the end of the phone call, I will say “It was nice meeting you, call me if you have any more questions”. One more time.

Tricare for Life still covers your copays on a Medicare Part C Plan.

I talk to TFL members everyday and I understand your concerns. My job is to explain how the plans work and then you can decide for yourself if you want to enroll.

Hopefully you have a better understanding of your options. I am licensed in the 38 states listed in green below, and can email you the plan specifics in your area by clicking on “Email Me Info“, phone number optional. I usually email the info within 5 minutes and never share your info with anyone!

The Annual Enrollment Period (AEP) is October 15th-Dec 7th. Anyone who enrolls during AEP, the plan becomes effective Jan 1st,2024.

You can also use the “Chat Now” tab at the bottom to chat with me in real time.

I do not offer every plan available in your area. Please contact Medicare.gov or 1-800-Medicare to get all of your options.

Give me a call at 303-335-9611

or email schrader470@gmail.com